The cat is finally out of the bag! Congratulations to Zeta Markets for completing their USD$8.5m strategic funding round!

We’re delighted to have participated in the latest round, and also to have co-led Zeta’s USD$800k seed round earlier this year.

Zeta is building a decentralised crypto options trading platform, providing institutions and retail traders with an effective, low-cost avenue to hedge their crypto positions and trade derivatives.

Unlocking crypto derivatives

The DeFi summer of 2020 was a turning point for crypto. The rise and adoption of protocols like Maker DAO, Compound, Aave, Uniswap and others saw the crypto markets finally enter the deployment phase and onboard millions of new users and tens of billions of total locked value. Institutional interest has followed, with more than $17 billion USD of institutional capital flooding the crypto space since the start of 2021.

Spot markets in crypto are well established: centralised providers like Binance and FTX as well as their decentralised counterparts like Uniswap and Sushiswap provide the ability to trade large spot volumes at low cost. However, this is not the case when it comes to derivatives.

In traditional finance, derivatives volumes (much of which is options) are many multiples of spot activity. However, crypto derivatives are currently a fraction of spot volume, and crypto options are only ~1.5% of total crypto derivatives volume.

The proportionally lower penetration rates are in part attributable to the lack of a viable crypto options platform that offers trading at; 1) high speed, 2) low cost, and 3) with material liquidity. This is largely due to existing Centralised Finance (“CeFi”) solutions (e.g. Coinbase & Binance) having high-cost, low flexibility products, while Decentralized Finance (“DeFi”) solutions (e.g. Hegic & Future swap) are struggling with execution speed and garnering liquidity.

Enter Zeta.

Zeta’s vision is to unlock options liquidity for the entire $2.6 trillion USD crypto ecosystem.

Zeta will offer a complete suite of decentralised derivatives, initially launching with European Options on the SOL/USDC pair, then branching out futures and options for popular currencies. The platform will include features traditionally found on institutional-grade centralized exchanges including, but not limited to; under-collateralized trading, portfolio cross-margin, sub-second mark-to-market updates, instant settlement, as well as an orderbook and matching engine.

Zeta is building on the Solana blockchain as its underlying infrastructure layer and Serum as its orderbook engine. Solana is the most performant scaled L1 blockchain today, offering ~50,000 transactions per second and very low fees. This, coupled with the team’s domain and technical expertise as ex-professional traders and trading platform engineers, uniquely positions them to build the go-to crypto derivatives platform of tomorrow.

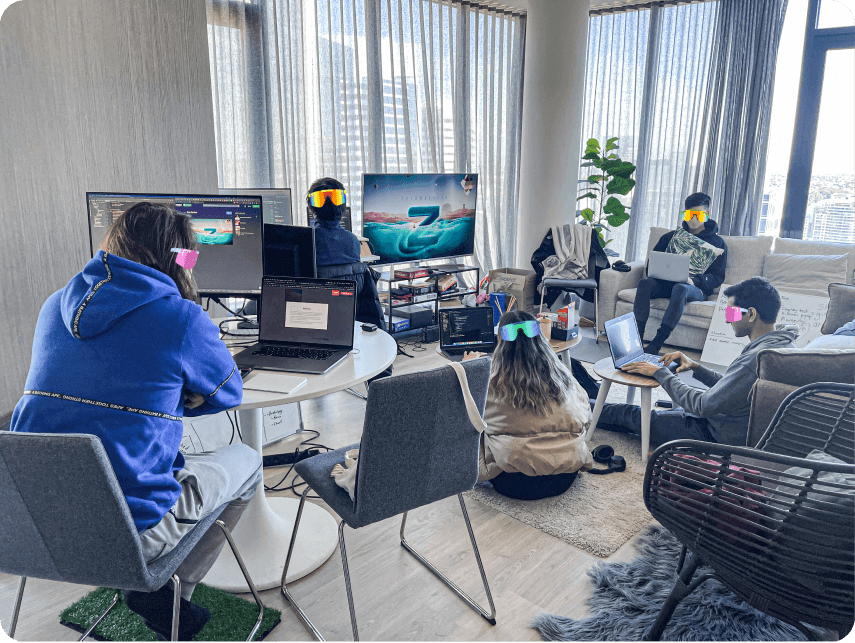

In 2 months following their public debut (May 2021), Zeta built a functional alpha version of a binary options trading platform. They went on to win the Solana Hackathon against +350 other submissions and have fostered a die-hard community of more than 23k+ followers across Twitter and Discord. Zeta’s execution has been world-class. Not only have we been impressed by their ability to build, but also by the passion and excitement of the community they’ve quickly amassed around them.

Our initial investment in Zeta was our first (and an Australian institutional VC first) token investment. We’re delighted to be supporting the project financially, as well as actively participating in the Zeta community, contributing to governance and providing cranking services to help them achieve network diversification. We are also helping Zeta recruit, and they are currently looking for great talent!

At Airtree, we are actively looking to support more DeFi projects. If you are building something to disrupt tradfi, please get in touch. Our DMs are open 🙂